How the S&P 500 Reacts After Interest Rate Cuts

The case for U.S. interest rate cuts has been growing, driven by weaker-than-expected economic data and easing inflation. While S&P 500 companies largely protected themselves from rising rates by securing lower rates in 2020 and 2021, many loans are due for renewal in 2025. Although returns after rate-cutting cycles have historically been positive, this upcoming period could pose unique challenges, especially for sectors like manufacturing that benefited from low rates but now face refinancing risks.

How Does the Stock Market React to Interest Rate Cuts?

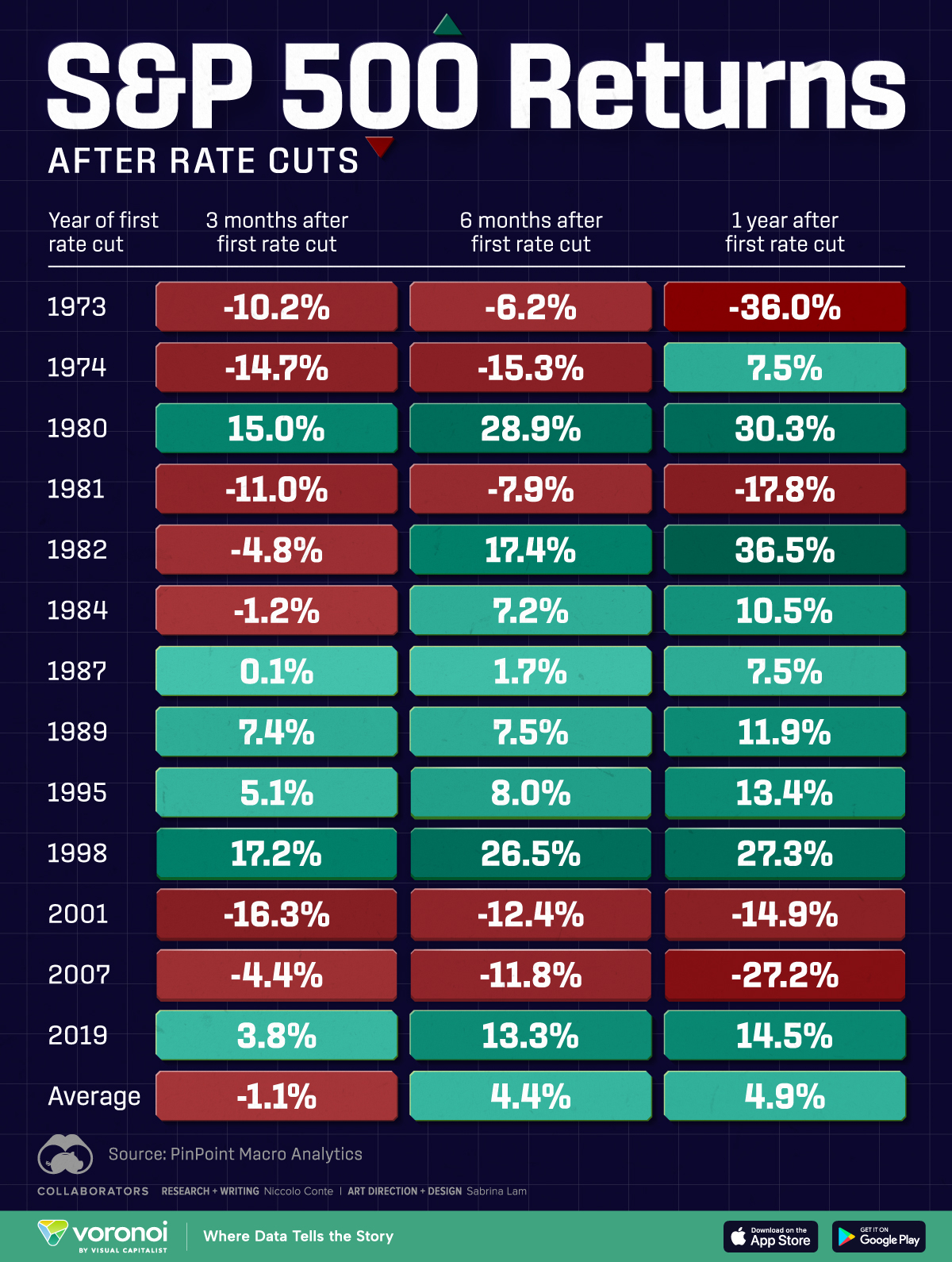

Over the past five decades, S&P 500 performance following the first interest rate cut varies significantly. The average return one year after a rate cut is 4.9%, with positive returns in nearly 70% of cases. However, market reactions differ based on economic context. For instance, while the S&P 500 saw significant declines after rate cuts in 1973, 1981, 2001, and 2007, it also experienced impressive growth, such as a 36.5% surge following the 1982 cut.

Typically, the market dips in the first three months after a rate cut but rebounds by the six-month mark. This aligns with the idea that lower interest rates stimulate economic activity by making borrowing cheaper for both businesses and consumers, eventually benefiting the stock market.

Still, interest rate cuts alone don't guarantee positive outcomes. Earnings growth plays a crucial role in market performance. When earnings rise after a rate cut, the S&P 500 averages a 14% return. In cases where earnings decline, returns are lower but still average around 7%.

In summary, while interest rate cuts are generally positive for the stock market, factors like earnings growth add nuance to this picture.